Every product must have a tax or VAT (Value Added Tax) rate assigned. If you are not using tax rates, add a default tax rate with default value of 0%.

Tax or VAT rates are set according to your country laws. If you are not informed about tax rates in your country, we strongly advise you to consult your accountant.

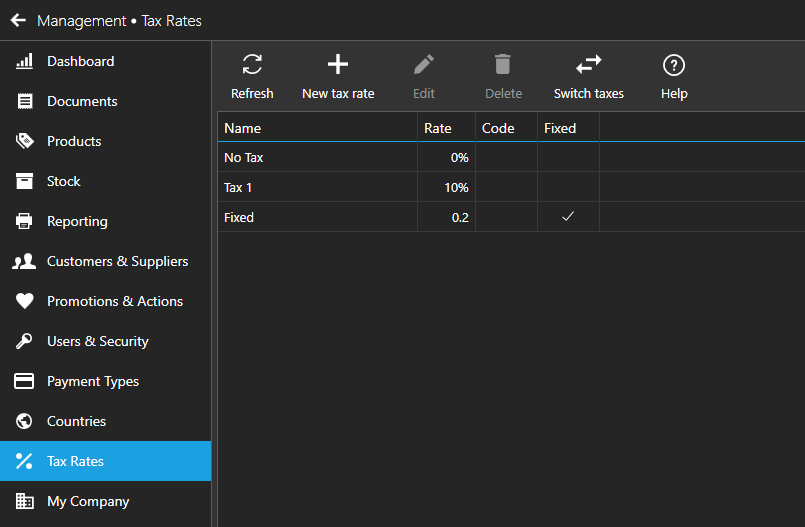

To access tax rates, open management and select tax rates from the left menu.

Add new tax rate

To add new VAT rate, click on "New tax rate" button in toolbar. Tax rate screen will appear with the following fields:

- Name

Tax name. Tax name is important if you choose to print tax name in receipts. - Code

If you are using tax codes, enter tax rate code.

Codes may vary by country (e.g. A, B, C, D), so we strongly advise you to consult your accounting if you are unsure of tax codes used in your country. - Rate

Enter tax rate. It can be set as either fixed amount or percents.

Example: For 10% tax rate, enter value "10" for rate - Fixed

Indicates whether tax rate is fixed. In this case, tax will be multiplied by quantity on item being sold or purchased.

When you are done entering tax rate properties, click "Save" button.

Edit tax rate

To edit existing tax rate, select the one you wish to modify and click "Edit" button.

Delete tax rate

To delete a tax rate, select the one you wish to delete and click "Delete" button.